Comprehending VAT, also known as VAT, stands as important for every business looking to thrive in the modern challenging environment. Being a transaction tax applied to goods and services, VAT fundamentally affects pricing, revenue, and finally, profits. To entrepreneurs, precisely determining VAT is not just a legal requirement; it's a strategic need that can affect liquidity and client contentment.

Using the right tools, including a VAT computation tool, businesses can simplify their VAT determinations, making sure they stay in compliance while improving their financial performance. Regardless of whether a small business or an well-established enterprise, nailing VAT assessments can avoid expensive mistakes and improve total operational efficiency. In the following article, we'll discuss the importance of VAT calculation, its implications for business health, and offer information on how to efficiently manage this essential element of fiscal management.

Understanding VAT Basics

Value Added Tax, commonly referred to as VAT, is a consumption tax placed on goods and services at every stage of manufacturing or distribution. Enterprises collect VAT from clients for the government and subsequently transfer it to the government. This tax is usually factored in the cost of goods, causing it to be crucial for businesses to correctly compute and file their VAT liabilities.

Comprehending how VAT operates is important for companies to maintain compliance and avoid potential penalties. VAT is calculated as a percentage of the selling price, and businesses can usually recover the VAT they pay on their acquisitions. This input tax deduction mechanism assists prevent the cascading effect of taxation, where various tiers of tax can be levied on the same sale. It’s essential for companies to maintain precise records of their sales, purchases, and VAT calculations.

Using a VAT calculator can ease the task of calculating the accurate amount of tax to gather and submit. These tools can help companies facilitate their VAT calculations and verify they adhere with existing laws. An accurate calculation not only complies with regulatory requirements but additionally contributes in improved financial planning and pricing models, contributing to the general well-being and growth of the company.

Ways to Utilize a VAT Calculator

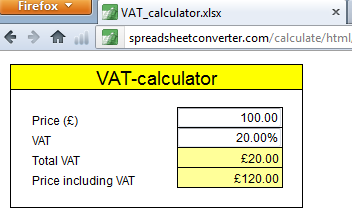

Utilizing a VAT calculator is a clear-cut process that can benefit organizations both hours and money. Initially, assemble all necessary information, such as the overall amount of the purchase and the VAT tax rate applicable to your products or offerings. A majority of VAT calculators enable you to key in these two key details to receive correct results in just a few clicks. Confirming that you have the correct figures is vitally important to avoid any mismatches.

Once you have typed in the transaction amount and the VAT tax rate into the calculator, just click on the solve button. The calculator will then provide you with the VAT amount payable and the final amount, factoring in VAT. This instant calculation can help simplify your invoicing process and gives understanding to your clients regarding the itemization of costs.

Finally, it's important to track track calculations for accounting purposes. Many VAT calculators have features that enable you to save or transfer your calculations. This digital record can be extremely useful during tax season or when you need to examine accounting records. By repeatedly using a VAT calculator, organizations can guarantee they remain compliant and confident in their economic transactions.

Frequent Value Added Tax Calculation Errors

One frequent mistake companies make when calculating VAT is incorrectly classifying goods and services. Various products frequently have different VAT rates, and not understanding the correct classification can lead to either charging too much customers or underreporting VAT liability. For instance, some items may be eligible for lower rates or exemptions, while others may be excluded. This misunderstanding can cause substantial financial implications if adjustments need to be made later.

Another common error arises from poor record keeping. calculate vat overlook to carefully track VAT collected on sales or the VAT paid on purchases. Without thorough records, it can become difficult to accurately complete VAT returns. This not only obstructs the correct VAT calculation but can also create suspicions during audits, potentially leading to penalties. Implementing a reliable bookkeeping system is vital to avoid this mistake.

Lastly, many companies overlook the importance of staying updated with VAT regulations and changes. Tax laws can evolve, and what was compliant yesterday may not be today. Failing to adjust processes accordingly can lead to incorrect calculations and lost revenue. Consistently consulting a VAT calculator or professional advice helps guarantee that businesses remain in compliance and mitigate the potentiality of issues in their VAT calculations.